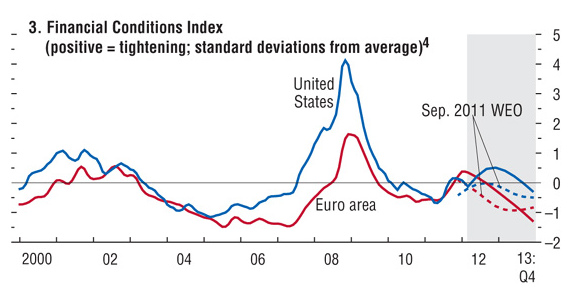

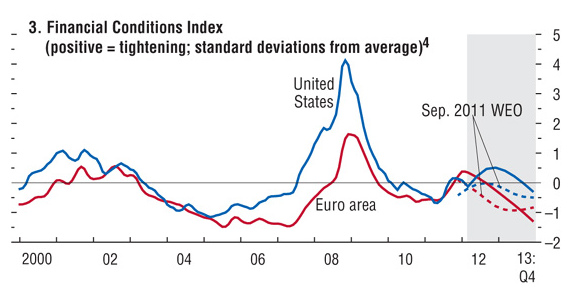

Financial conditions in emerging markets began to tighten during the

fall of 2011. Amid a general flight from risk, interest rate spreads

rose. Funding conditions worsened for banks, contributing to a

tightening of lending standards, and capital inflows diminished.

However, these flows are now returning with new vigor, and risk spreads

have come down again.

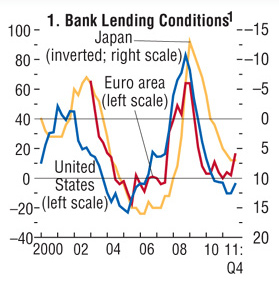

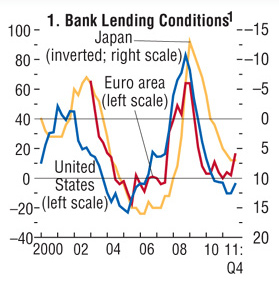

1Percent of respondents describing lending standards as tightening “considerably” or “somewhat” minus those indicating standards as easing “considerably” or “somewhat” over the previous three months. Survey of changes to credit standards for loans or lines of credit to firms for the euro area; average of surveys on changes in credit standards for commercial/industrial and commercial real estate lending for the United States; diffusion index of “accommodative” minus “severe,” Tankan survey of lending attitude of financial institutions for Japan.

Lending conditions tightened noticeably in the euro area recently, and credit growth slumped in late 2011. Developments were more positive in the United States and Japan. Looking ahead, conditions can be expected to ease somewhat. While the central bank balance sheet has expanded noticeably in the United States and the euro area, it has not done so in Japan. Broad money growth has remained very subdued in the euro area and Japan but has picked up in the United States, consistent with improving activity.

Source URL: http://www.elibrary.imf.org/view/IMF081/12281-9781616352462/12281-9781616352462/ch01.xml

1Percent of respondents describing lending standards as tightening “considerably” or “somewhat” minus those indicating standards as easing “considerably” or “somewhat” over the previous three months. Survey of changes to credit standards for loans or lines of credit to firms for the euro area; average of surveys on changes in credit standards for commercial/industrial and commercial real estate lending for the United States; diffusion index of “accommodative” minus “severe,” Tankan survey of lending attitude of financial institutions for Japan.

Lending conditions tightened noticeably in the euro area recently, and credit growth slumped in late 2011. Developments were more positive in the United States and Japan. Looking ahead, conditions can be expected to ease somewhat. While the central bank balance sheet has expanded noticeably in the United States and the euro area, it has not done so in Japan. Broad money growth has remained very subdued in the euro area and Japan but has picked up in the United States, consistent with improving activity.

Source URL: http://www.elibrary.imf.org/view/IMF081/12281-9781616352462/12281-9781616352462/ch01.xml

全站熱搜

留言列表

留言列表